- Out of Pocket (OOP) Expenses

- Out of Pocket Setup

- Mileage

- Reimbursement

- OOP/Mileage Expenses

- Approvals / Documentation

Out of Pocket:

An Out of Pocket (OOP) expense is an allowable (per policy) business expense paid with personal funds.

Out of Pocket expenses are different from a Purchasing Card because an individual is using personal funds and they will need to be reimbursed. An individual does not need a Purchasing Card (PCard) to be set up in Out of Pocket (OOP).

Out of Pocket reimbursement should only be used in the event a merchant foes not accept credit cards and for allowable business mileage. Individuals should not use their own funds for business purchases or payments.

Fairview uses the same electronic system for both the PCard and Out-of-Pocket expenses.

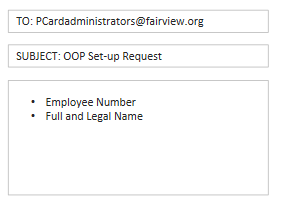

Steps to setup an Out of Pocket request:

- OOP set up requests should be sent to Pcardadministrators@fairview.org

- They must be initiated by the manager and include the employee number and full legal name.

- requests should not be made until there is a need for expense reimbursement.

- Employees will be a sent a confirmation and directions after the setup is complete.

Example:

What is allowable to claim as a Business Mileage?

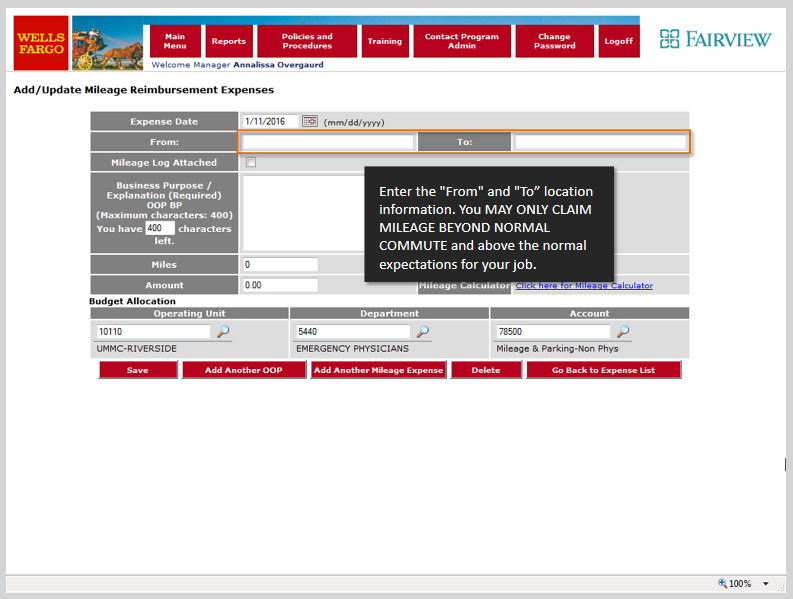

Individuals, who use their own car for business purposes, including traveling between Fairview entities in a given day. will be reimbursed for mileage, in excess of their normal commute, at the rate consistent with the current optional standard mileage rate set by the IRS. The employee must provide for substantiation purposes the date, location, mileage and business purpose of those trips.

The following are examples of current employee work commutes:

- Commute to the same location each day and then to another location during the same day as part of their normal job duties.

- Commute to one location on certain days of the week. Drive to another location on other days of the week. They spend the day at a single location.

- Commute to the same location each day, but may work a split shift or have to come back to perform certain duties later the same day.

- Commute to the same location each day, but periodically may have to go to another location for a day to attend meetings.

When and how do I get reimbursed for Out of Pocket (OOP) expenses?

- Reimbursement is based on Manager Approval and outlined in the monthly approval email.

- It is included on your paycheck as a separate line item.

- OOP is not considered taxable income.

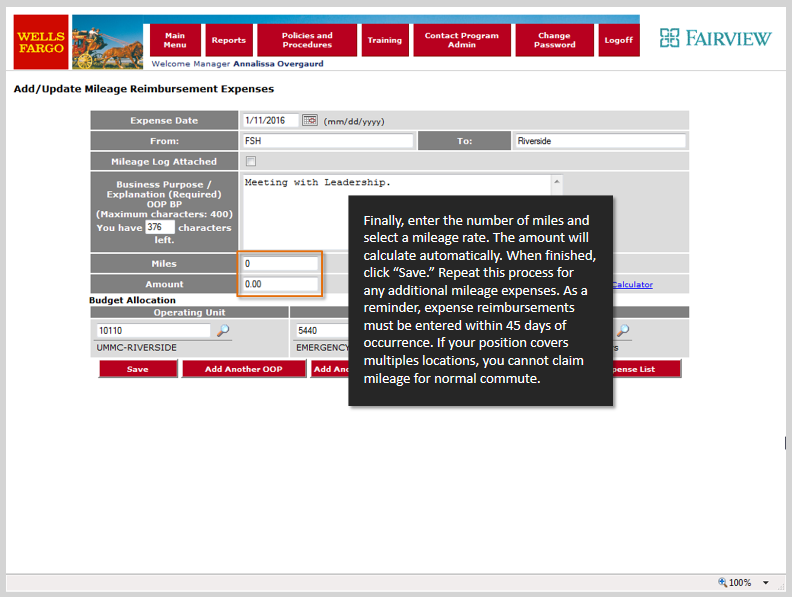

- Reimbursement must be submitted within 45 days of occurrence.

All OOP expenses require itemized original receipts with the exception of mileage.

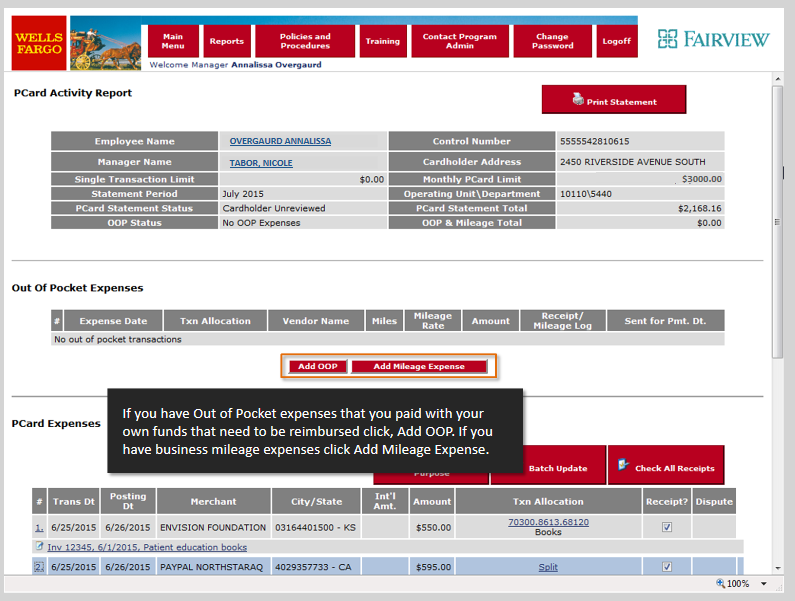

Entering your OOP expenses:

- Enter your OOP expenses and Mileage Expenses by clicking the designated buttons.

2. To add allowable OOP expenses click the Add OOP button.

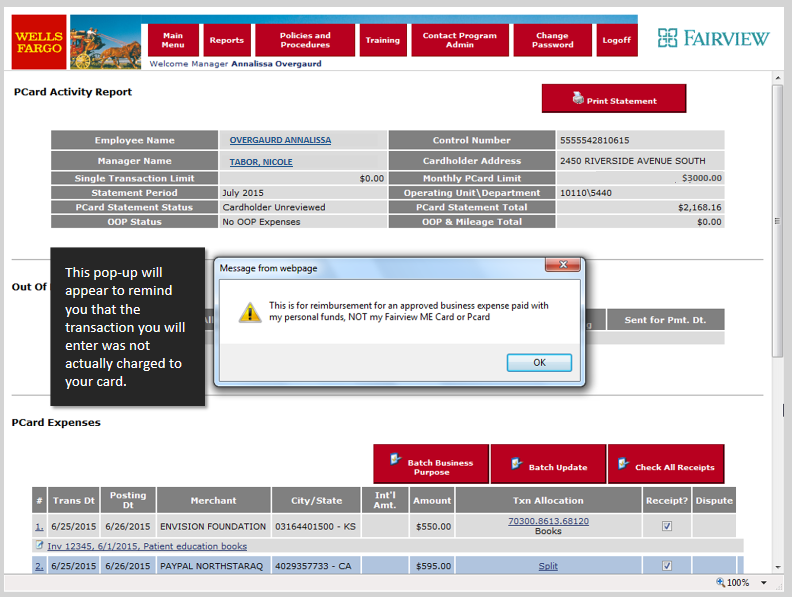

3. Reminder will pop up to make sure you are not requesting reimbursement for something put on a PCard.

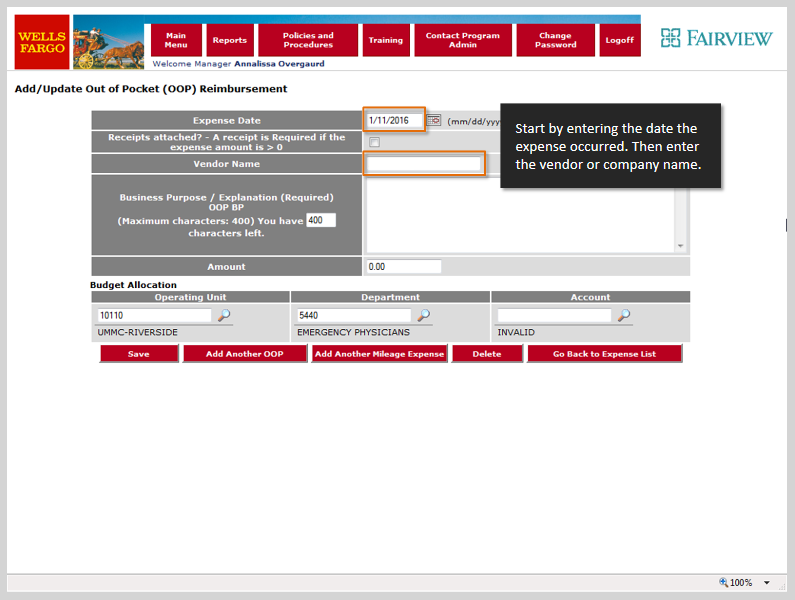

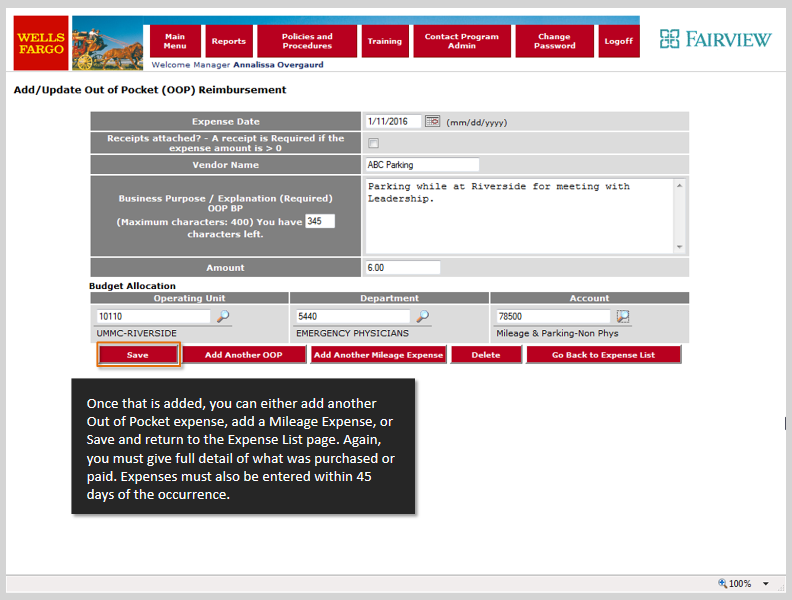

4. Enter the date the expense occurred and the vendor or company name.

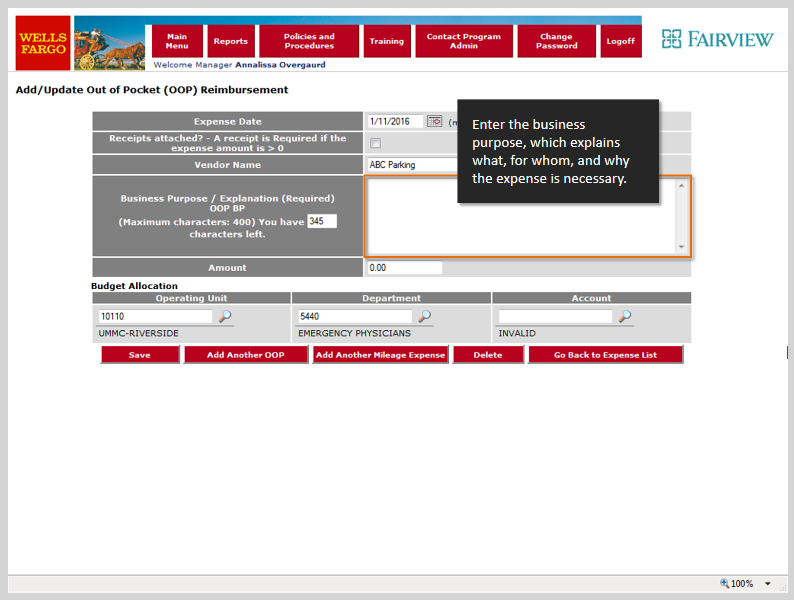

5. Enter the business purpose – when, where , why the expense is necessary.

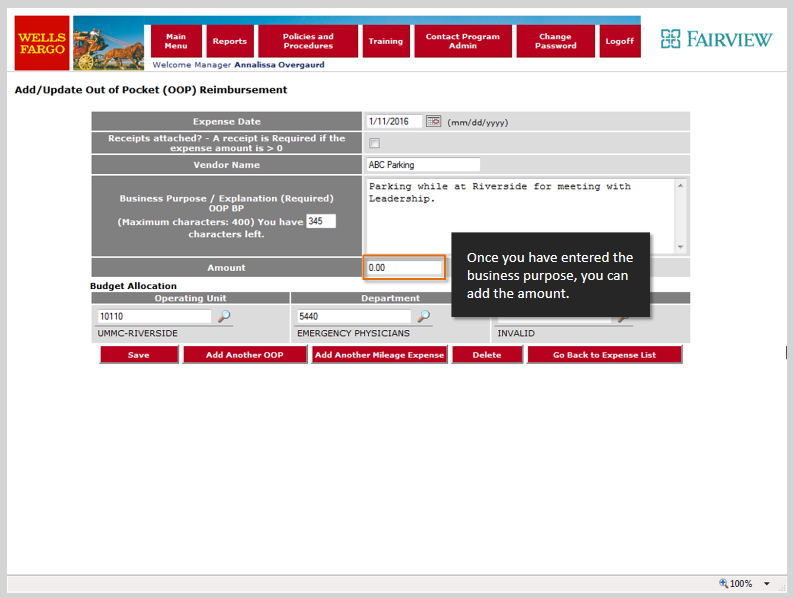

6. Add the reimbursement amount

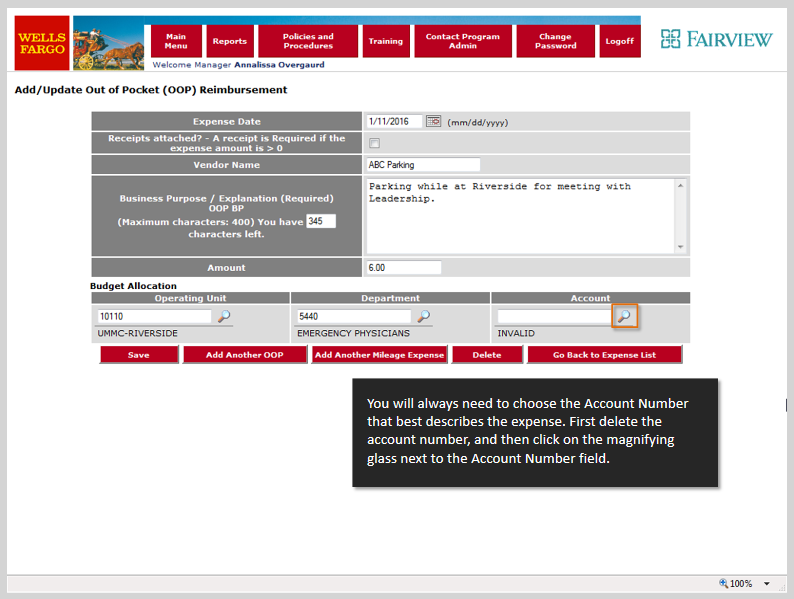

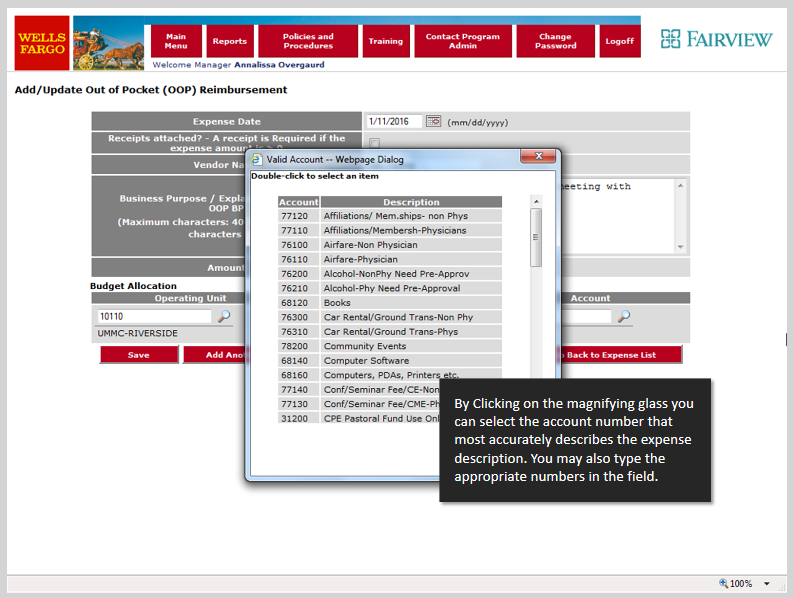

7. Enter the correct account number for the type of expense.

8. Use the magnifying glass to select the correct account.

9. At this point you can add another OOP expense, add mileage or save and return to the list page.

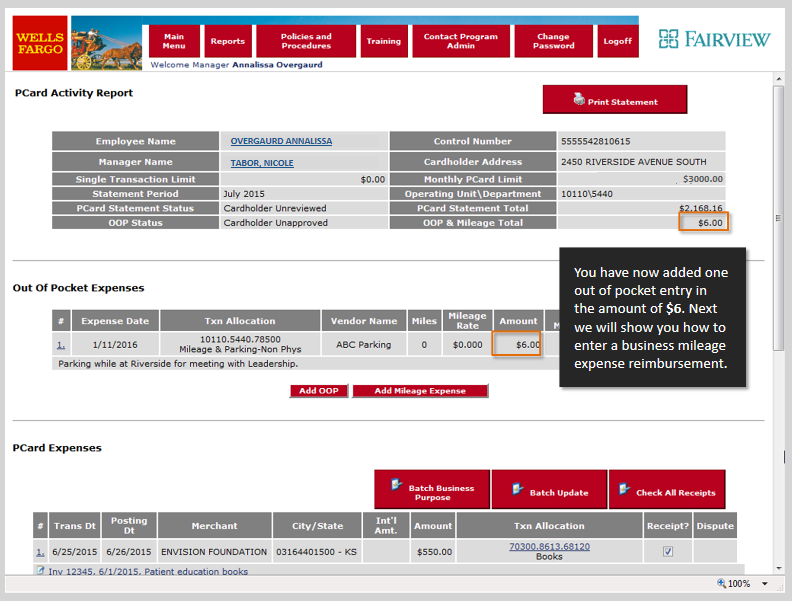

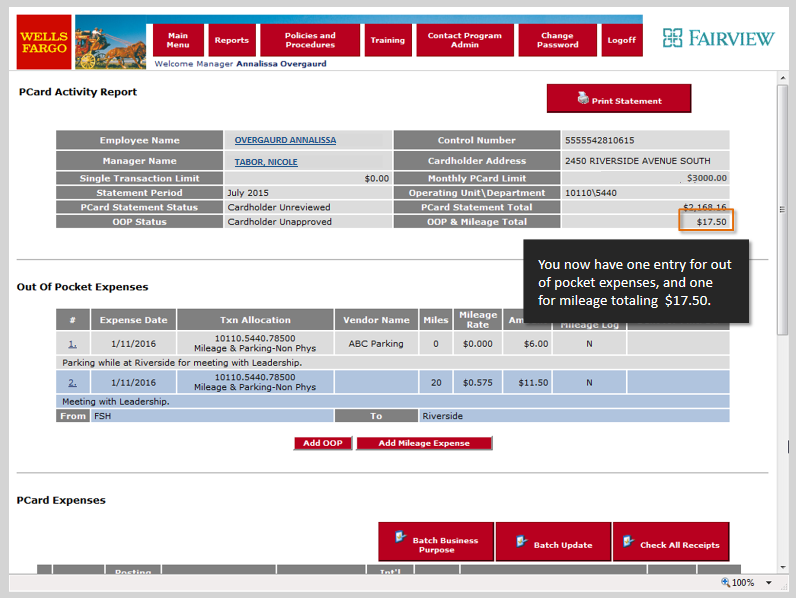

10. Your updated expense amount will be visible on the Pcard Activity report page.

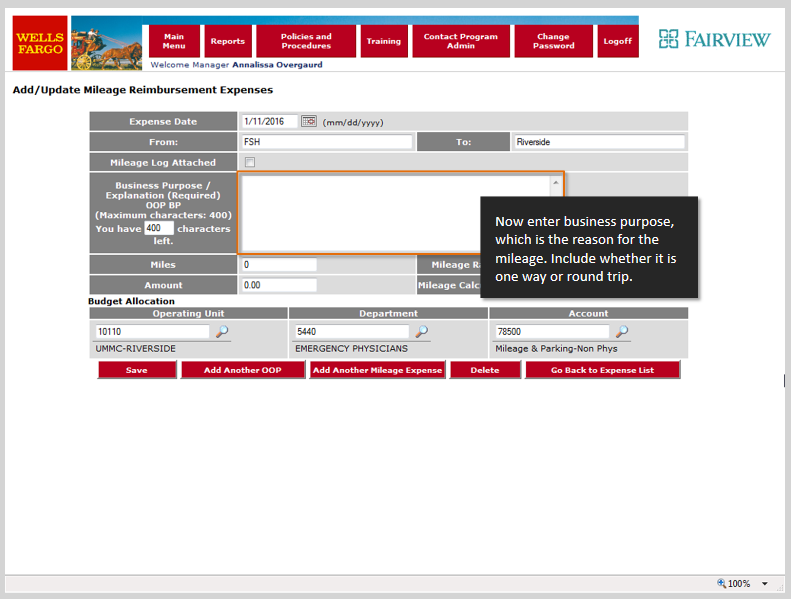

11. To add mileage expense click Add Mileage Expense

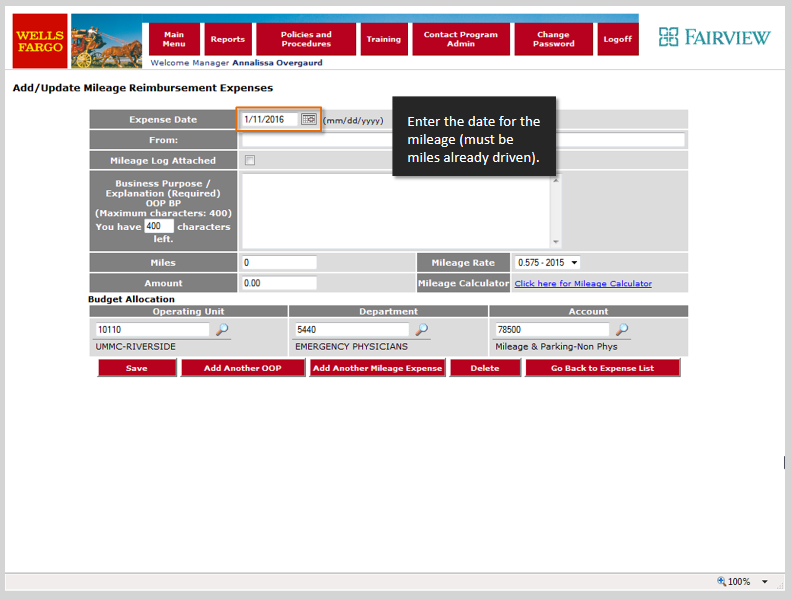

12. Enter the date for the mileage

13. Enter To and From locations

14. Enter the business purpose

15. Enter the number of miles and the rate will populate automatically.

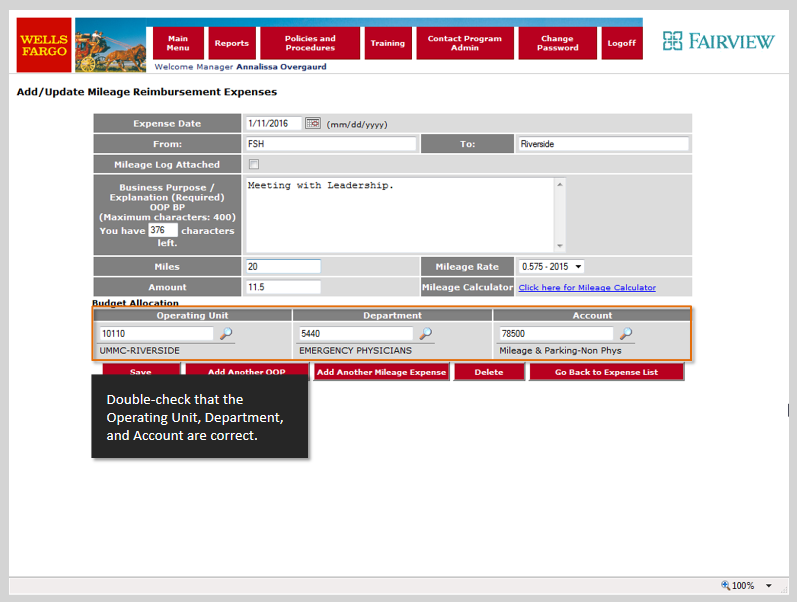

16. Check the Operating Unit, Department and Account number for accuracy. If accurate, click the save button.

17. Your total for both Mileage and OOP expense will be totaled together.

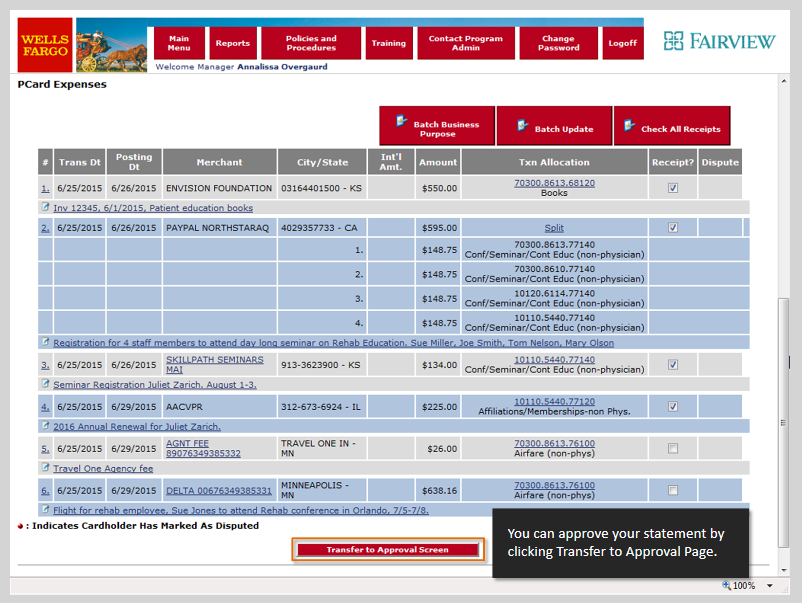

Approving your PCard Statement:

Once you have reconciled your PCard transactions and have entered your allowable OOP expense reimbursements, you can approve your statement (if applicable) or log out and return later for approval.

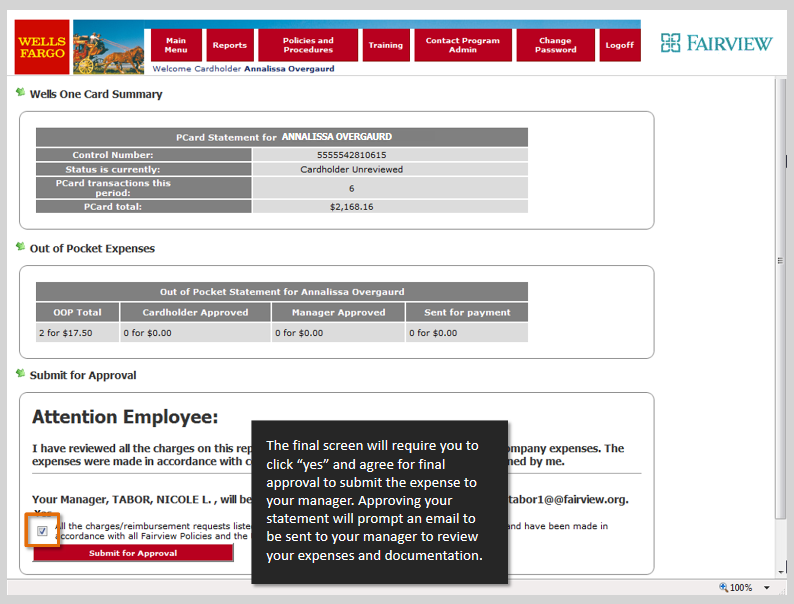

Click “yes” and agree for final approval to submit the expense to your manager.

You will now print your statement and attach any required documentation and forward the information to your designated manager for review and approval. This should be done 3 days prior to the last day of the month.